Property prices continue their rapid improvement

Property prices continue to rise nationwide, with significant growth in both metropolitan and regional areas.

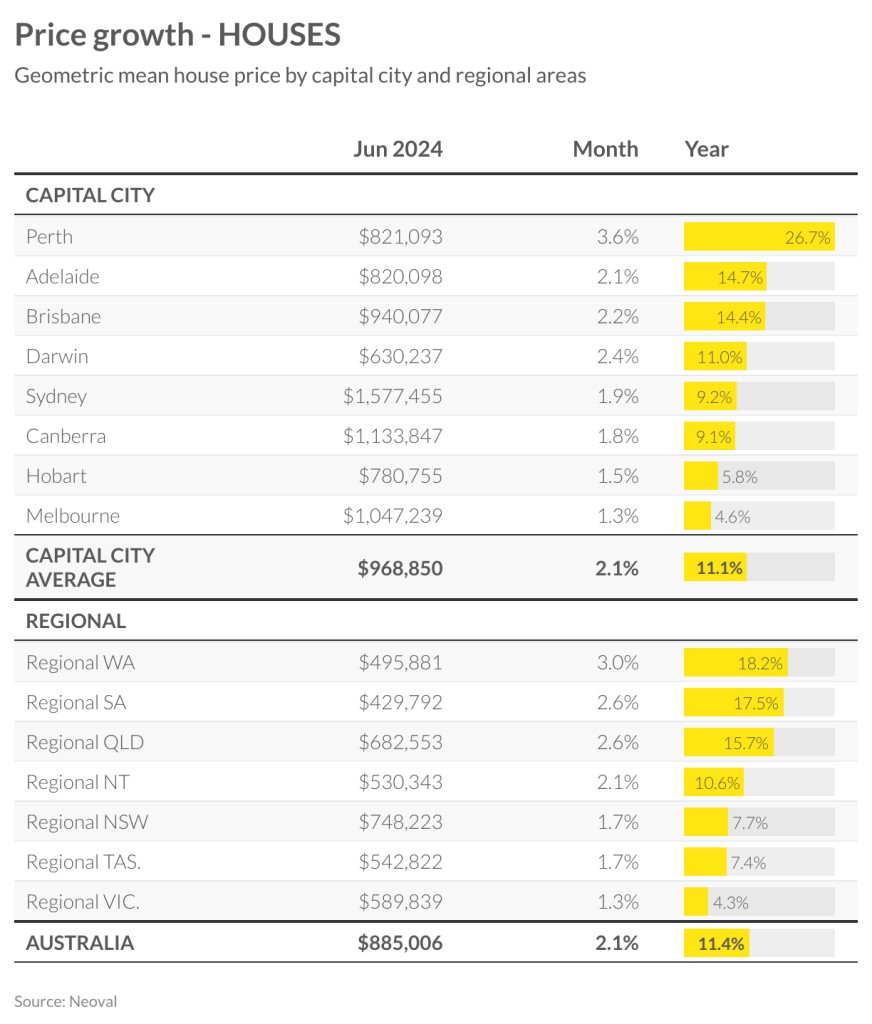

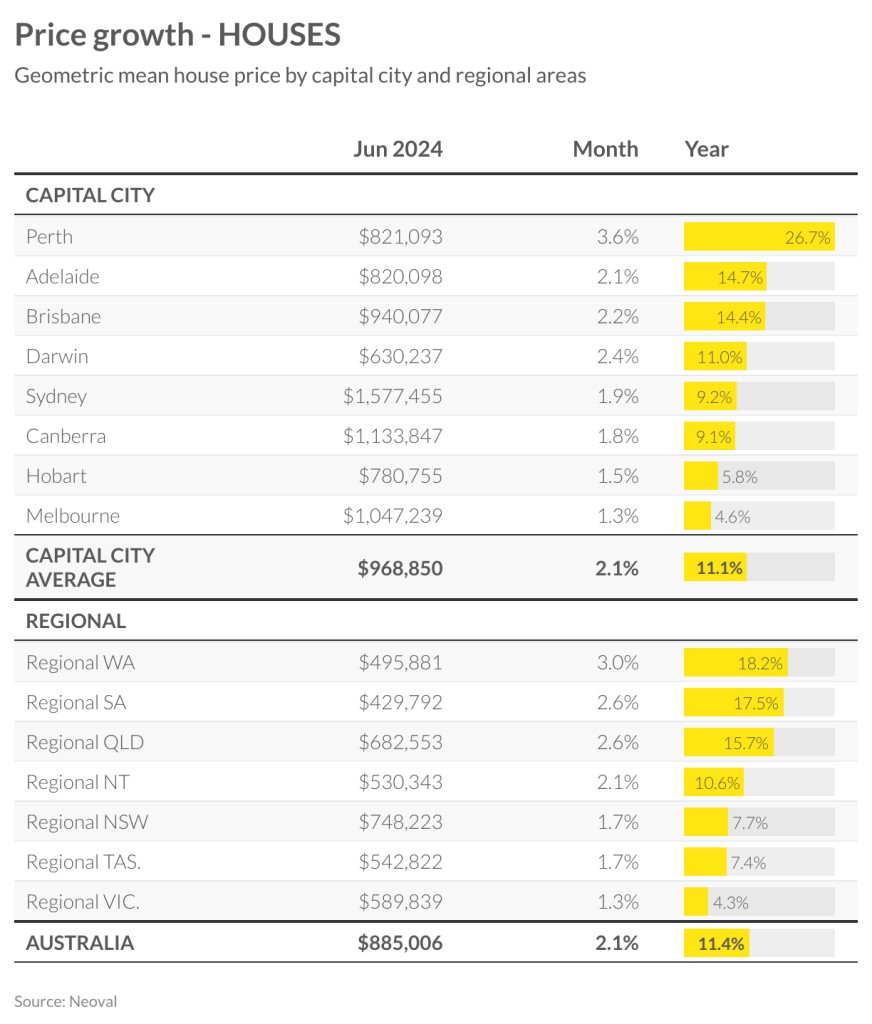

Western Australia stands out, surpassing national averages. Perth has become Australia’s fifth most expensive housing market, overtaking Adelaide with a median house price of $821,093, reflecting a 3.6 per cent monthly increase and a remarkable 26.7 per cent annual growth.

Adelaide and Brisbane maintain strong annual growth rates of 14.7 per cent and 14.4 per cent respectively, while Melbourne, though still growing, lags behind at 1.3 per cent monthly growth, below the national average of 2.1 per cent.

Regional markets show less dramatic changes, with Western Australia leading despite median prices remaining under $500,000, making it one of the more affordable regions. South Australia and Queensland demonstrate steady growth at 2.6 per cent monthly, while Victoria, Tasmania, and New South Wales fall below the national regional average of 2.1 per cent.

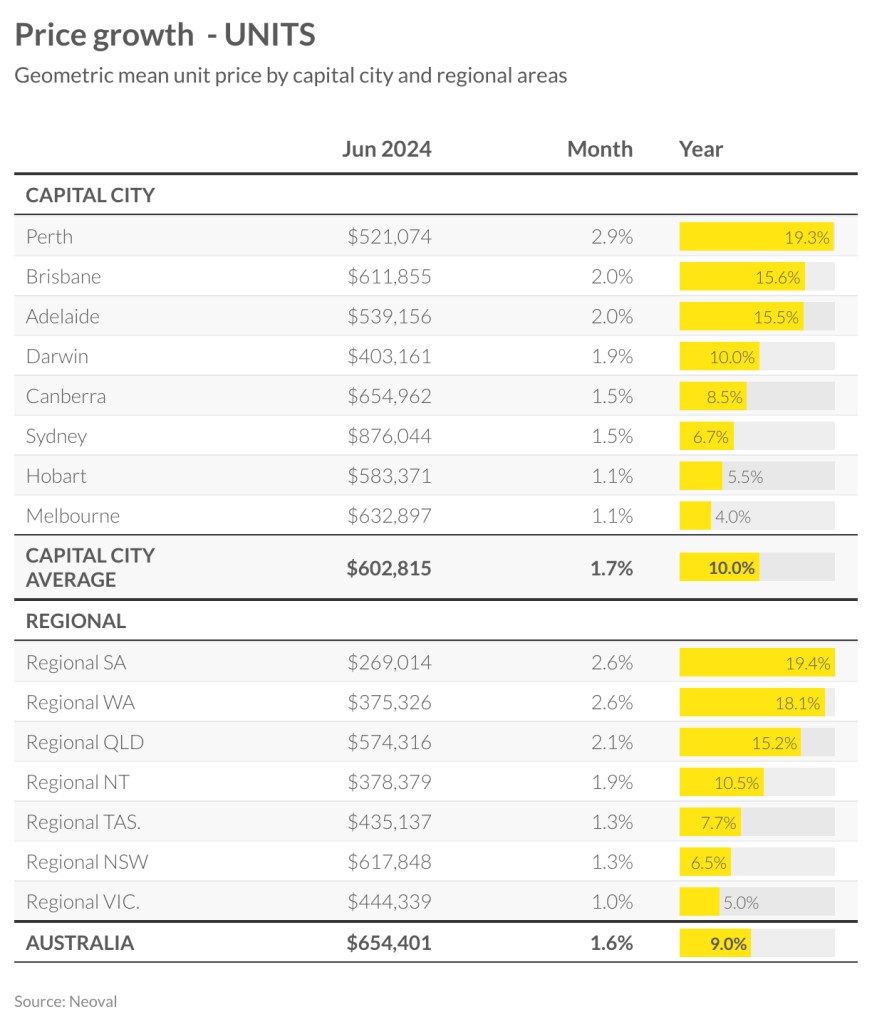

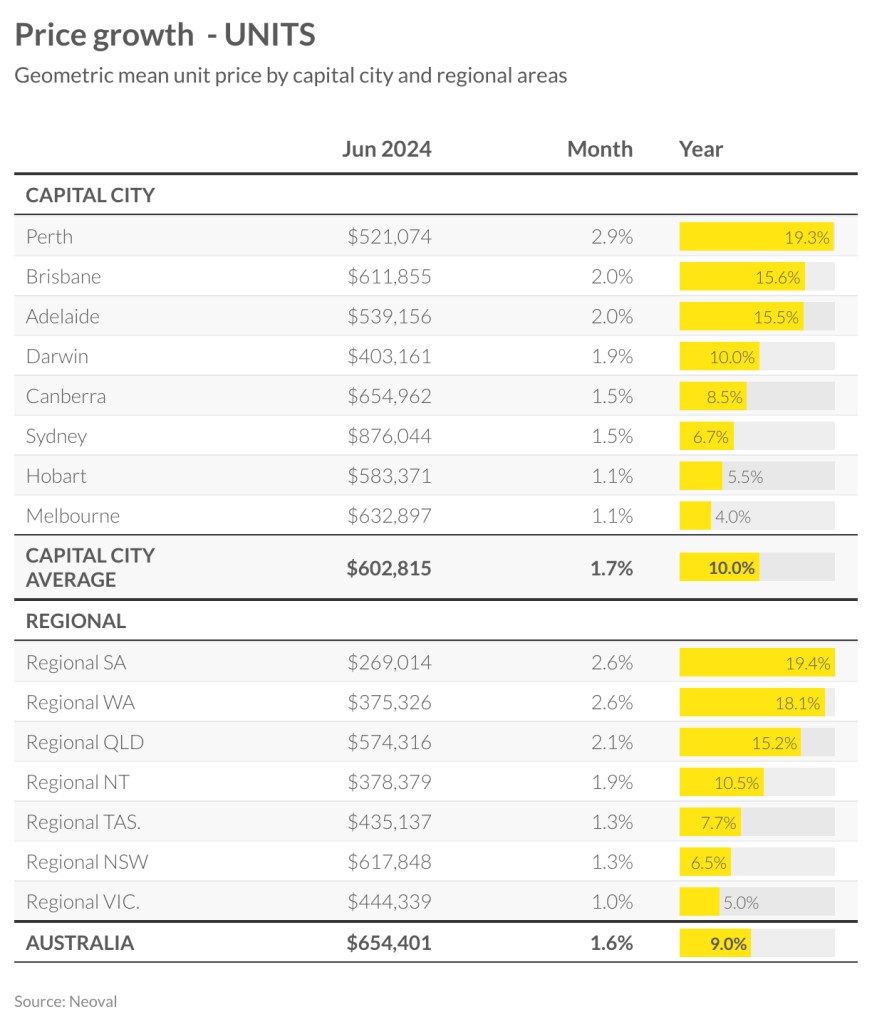

The unit market mirrors house market trends. All areas show positive growth, with Melbourne and Hobart trailing at 1.3 per cent and 1.5 per cent respectively. Perth leads at 2.9 per cent, followed closely by Brisbane and Adelaide. Sydney and Canberra show more modest yet positive annual growth at 6.7 per cent and 8.5 per cent. Regional unit prices keep pace with capital cities, rising 1.6 per cent monthly and nine per cent annually.

Looking forward, recent inflation data has reignited discussions about potential interest rate hikes, which could impact property listings. The ongoing imbalance between housing supply and demand continues to drive price increases, while affordability concerns grow amid persistent inflationary pressures.