So how can you get into your own place as quickly as possible while still paying the rent? We asked a financial adviser for his tips on what renters can do to increase their chances of buying.

The challenge of saving a deposit

According to Martin Speiser from Masu Group, the biggest obstacle for renters who want to buy is saving a deposit, particularly in big cities where rents are high.

“Renters are spending a lot of their disposable income on rent,” Speiser says. “This makes saving very hard.”

“It is also tough for young people as lifestyle is a priority – so it’s hard to tell a twenty-something not to go out and party or travel,” he says.

Despite the challenge, Speiser says saving a deposit is critical.

“Banks no longer lend 100% of the purchase price, so without a deposit you cannot buy,” he says. “It is also more difficult for parents or others to go as guarantors of loans these days”.

But while saving a deposit should be the main focus of renters who want to buy their own property, there are some other things to keep in mind.

Look at the bigger picture

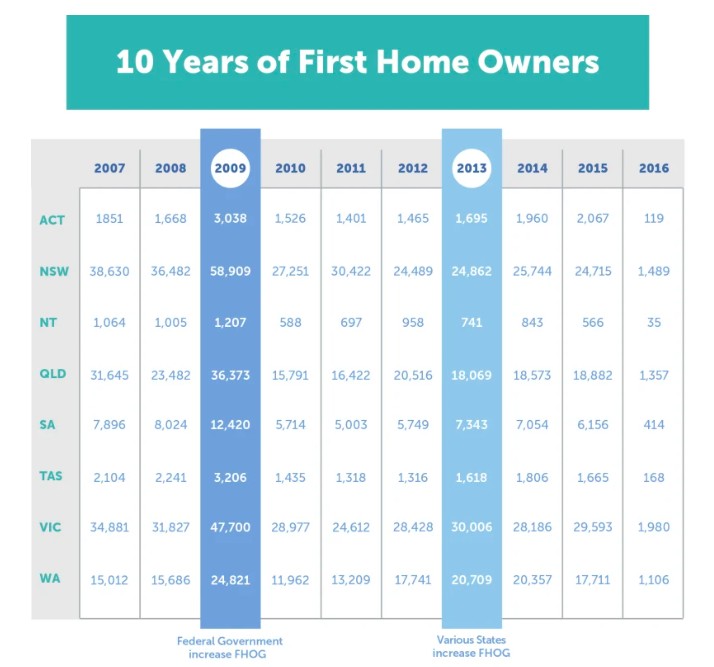

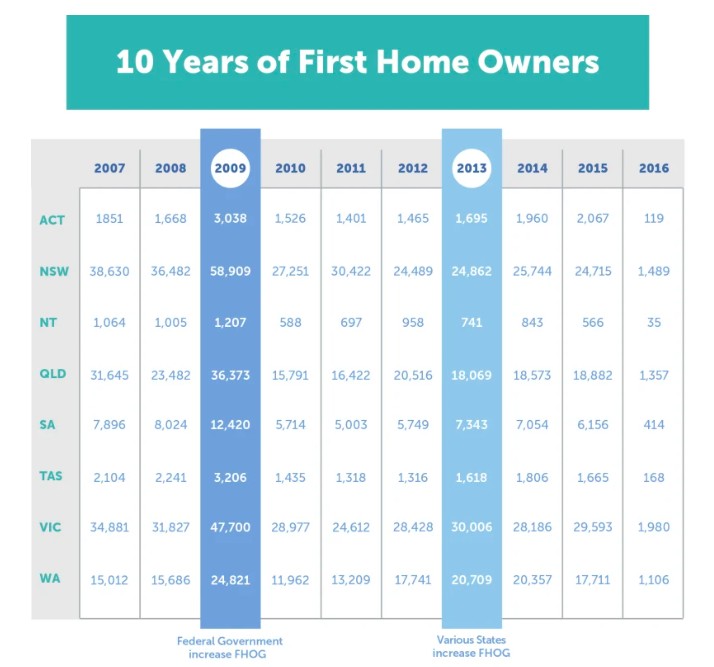

Speiser says changes to the first home owner’s grant and the limiting of stamp duty concessions in some states doesn’t help.

This has often happened at the very same time as property prices increased.

Source: Australian Bureau of Statistics.

*Figures represent the number of homes purchased using FHOG up until January 2016.

This means it pays to spend time looking at the bigger picture and how this could affect your ability to buy property, whether positively or negatively.

“As prices increase, affordability reduces, and the deposit required increases,” Speiser says.

Speiser also says that, far from being a benefit to new home buyers, low interest rates actually make saving harder.

“You would think low interest rates would help buyers,” Speiser says. “However, if you are trying to save in a bank and interest yields are 2%, that’s not a lot of growth you are getting.”

Bank policies on lending have also been shifting – not only the Loan to Valuation Ratio (LVR) or how much they will lend on the value of the property, but also their willingness to lend in certain areas where they feel there is oversupply, like Docklands in Melbourne.

“If they do lend, it may be at lower LVRs,” Speiser says. “And the lower the LVR the higher the deposit needed.”

Prepare yourself financially

Speiser’s advice to those looking to purchase property is simple.

“Save, save, save, and try not to rack up personal loans and credit card debt,” he says. “If there are large credit card debts it could be detrimental to your borrowing ability.”

And be pragmatic about how you can help yourself achieve your goal.

“Many young people also choose to stay at home longer to save,” Speiser says.

Research the property market

Speiser says that, while most people know where they would like to live, you should always thoroughly research the property market and be open to exploring the benefits of new areas. Consider essentials such as access to public transport, schools, shops and other amenities, as well as any negatives.

And use sites like realestate.com.au/invest to check recent sales prices and go and visit properties currently on the market to see what your money really buys you.

Take a long-term view

If you can’t afford the area you like or the property that suits your lifestyle another option can be to buy an investment property. Speiser says this can be a good idea provided you have a long-term time frame.

“Generally property investing should be done with an eight to ten year time frame,” Speiser says. “I have seen many cases where people who rent and buy investment properties are better off long term than those buying a home and paying it off.”

But this is not a one-size-fits-all approach to getting on the property ladder and Speiser cautions that many factors need to be considered including the type of property, the potential for growth, income and the effect of negative gearing.

There’s also the option of buying off-the-plan. While Speiser says it is not without its own risks, it can help you keep saving a deposit while getting a foot on the property ladder.

Be informed about the process

Speiser says renters should also spend time researching the process of buying their own property and be fully informed about the costs – from stamp duty to legal or conveyancing fees.

For instance, prospective buyers should be aware that banks will not lend on the purchase price, they lend on valuation.

“If the valuation comes in lower than the purchase price then more of a deposit is needed,” Speiser says.

Written by Emma Sorensen, Writer and published on Realestate.com.au